Monthly Market Report August 2023

As summer draws to a close, we can observe an interesting shift in the Metro Vancouver housing market. The arrival of higher borrowing costs has begun to exert its influence. The once-hot property prices are cooling down, and the pace of sales is following the typical seasonal pattern.

This spring and summer has provided an intriguing narrative in the real estate world. Borrowing costs have been riding a rollercoaster, reaching levels not seen in over a decade. Remarkably, despite dire predictions of a substantial market slowdown, Metro Vancouver’s housing sector has defied expectations. Sales remain strong, and year-to-date price gains stand at an impressive eight percent or more for all property types.

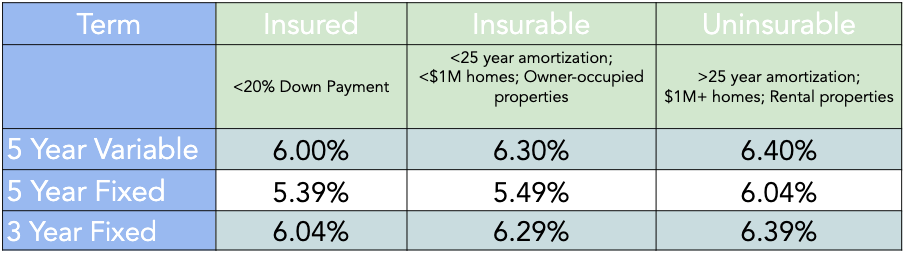

Sales began the year at a leisurely pace while prices soared due to limited housing inventory. Now, as we approach fall, sales have caught up with the price gains, but both indicators are settling into a more familiar rhythm aligned with historical seasonal trends. This moderation is not unexpected, especially considering the prevailing borrowing costs.

In July, the Consumer Price Index in Canada saw a year-over-year increase of 3.3%, following a 2.8% rise in June. This marks the first time since the pre-pandemic period that Canadian inflation has surpassed that of the United States. The driving forces behind this surge are primarily attributed to higher electricity prices in Alberta, increased airfares, and a rise in travel service costs. Additionally, gasoline prices contributed to the acceleration, albeit at a slower rate compared to June.

Derek Holt, head of Scotiabank Capital Markets Economics, emphasizes the need for the Bank of Canada to take an aggressive stance with further rate hikes. He highlights that failure to do so could lead to losing the battle against inflation, especially if wages and inflation expectations start to spiral out of control.

On Wednesday September 6, The Bank of Canada has opted to maintain its overnight rate at 5%, with the Bank Rate and deposit rate also remaining stable. Furthermore, the bank is continuing its quantitative tightening policy. Globally, inflation in advanced economies is gradually receding, though core inflation remains a concern for major central banks. China’s growth has slowed significantly due to weaknesses in the property sector, while the United States saw stronger-than-expected growth, primarily driven by robust consumer spending. In Canada, economic growth has slowed, influenced by reduced consumption, decreased housing activity, and natural disasters. Inflationary pressures persist, with CPI inflation at approximately 3%. The bank remains vigilant about inflation and is prepared to increase interest rates if necessary to restore price stability.

The next update is scheduled for October 25, 2023, with ongoing assessments of inflation and economic dynamics.

For all your real estate related needs.

Mindy Minhas PREC 🍁

Sutton Group West Coast

📲 778 839 7615

🖥️ WWW.MINDYMINHAS.COM

✉️ MINHASMINDY@GMAIL.COM